Suncor Energy Announces 2023 Production Outlook and Capital Program

Brand Story

29 Nov 2022, 21:13 GMT+10

Calgary, Alberta--(Newsfile Corp. - November 29, 2022) - Suncor Energy (TSX: SU) (NYSE: SU) released its 2023 corporate guidance today.

'Over the past several months, our new mining leadership has done an in-depth review of our assets and developed a multi-year plan that will deliver marked improvements in safety, reliability and operational performance,' said Kris Smith interim president and chief executive officer. 'In addition, we will continue to optimize our assets to drive value and future growth in areas that are complementary to our base business.'

Members of the Suncor leadership team will discuss this outlook later today at the Company's previously scheduled Investor Presentation beginning at 11 a.m. MT / 1 p.m. ET. A webcast of the event will be available at Suncor.com.

2023 Full Year OutlookNovember 29, 2022

Suncor Total Production (boe/d) (1)

740,000

-

770,000

Oil Sands Operations (bbls/d) (2)

385,000

-

425,000

Synthetic Crude Oil (bbls/d)

290,000

-

310,000

Bitumen (bbls/d)

95,000

-

115,000

Fort Hills (bbls/d) Suncor working interest of 75.41% (3)

90,000

-

100,000

Syncrude (bbls/d) Suncor working interest of 58.74%

175,000

-

190,000

Exploration and Production (boe/d) (4)

65,000

-

75,000

Suncor Refinery Throughput (bbls/d)

430,000

-

445,000

Suncor Refinery Utilization (5)

92%

-

96%

Refined Product Sales (bbls/d)

550,000

-

580,000

1) Production ranges for Oil Sands operations, Fort Hills, Syncrude and Exploration and Production are not intended to add to equal Suncor Total Production. 2) Oil Sands operations production includes synthetic crude oil, diesel, and bitumen and excludes Fort Hills PFT bitumen and Syncrude synthetic crude oil production. These ranges reflect the integrated upgrading and bitumen production performance risk. 3) Fort Hills production assumes Suncor's incremental 21.3% share of Fort Hills production acquired from Teck Resources Limited is effective April 1, 2023. 4) Exploration and Production volumes assume UK divestiture takes place effective June 30, 2023. 5) Refinery utilization is based on the following crude processing capacities: Montreal - 137,000 bbls/d; Sarnia - 85,000 bbls/d; Edmonton - 146,000 bbls/d; and Commerce City - 98,000 bbls/d.

Capital Expenditures (6)

(C$ millions)

2023 Full Year OutlookNovember 29, 2022

% Economic Investment (8)

Upstream Oil Sands (7)

3,625

-

3,875

30%

Upstream E&P

725

-

775

100%

Total Upstream

4,350

-

4,650

45%

Downstream

1,025

-

1,100

25%

Corporate

25

-

50

45%

Total

5,400

-

5,800

40%

6) Capital expenditures exclude capitalized interest of approximately $180 million.

7) Upstream Oil Sands capital expenditure includes approximately $100 million for Suncor's incremental 21.3% share of Fort Hills acquired from Teck Resources Limited, which is assumed to close on April 1, 2023.

8) Balance of capital expenditures represents Asset Sustainment and Maintenance capital expenditures. For definitions of Economic Investment and Asset Sustainment and Maintenance capital expenditures, see the Capital Investment Update section of Suncor's Management's Discussion and Analysis for the Third Quarter of 2022 dated November 2, 2022 (the 'MD&A'), available at www. sedar.com.

Suncor's corporate guidance provides management's outlook for 2023 in certain key areas of the company's business. Users of this forward-looking information are cautioned that actual results may vary materially from the targets disclosed. Readers are cautioned against placing undue reliance on this guidance.

For more detail on Suncor's outlook and capital spending plan, see suncor.com/guidance.

For an updated Investor Relations presentation and the third quarter Investor Relations deck, see suncor.com/investor-centre.

Legal Advisory - Forward-Looking Statements

This news release contains certain forward-looking information and forward-looking statements (collectively referred to herein as 'forward-looking statements') within the meaning of applicable Canadian and U.S. securities laws. Forward-looking statements in this news release include references to: the expectation that Suncor's capital spending program will be approximately $5.4 to 5.8 billion and expectations of where that spending will be directed; Suncor's expectations around production, including planned average upstream production of 740,000 - 770,000 boe/d and planned ranges for Oil Sands operations (385,000 - 425,000 bbls/d), made up of Synthetic Crude Oil (290,000 - 310,000 bbls/d) and Bitumen (95,000 - 115,000 bbls/d), Suncor's working interest in Fort Hills (90,000 - 100,000 bbls/d), Suncor's working interest in Syncrude (175,000 - 190,000 bbls/d) and Exploration & Production (65,000 - 75,000 boe/d); Suncor's expected Oil Sands operations cash operating costs, projected to be in the range of $30.00 - $33.00 (US $22.80 - $25.10) per barrel; expected Fort Hills cash operating costs, projected to be in the range of $33.00 - $36.00 (US $25.10- $27.40) per barrel; expected Syncrude cash operating costs, projected to be in the range of $39.00 - $43.00 (US $29.60 - $32.70) per barrel; Suncor's expected Refinery Throughputs (430,000 - 445,000 bbls/d) and Utilization (92% - 96%); Suncor's expected Refined Product Sales (550,000 - 580,000 bbls/d); the expected impacts of planned maintenance, including the major planned maintenance turnaround at both Base Plant U2 and at Fort Hills; the expectation that Terra Nova will start production during the 1st quarter of 2023; the expected timing of Suncor's acquisition of an incremental 21.3% share of Fort Hills and the UK divestiture in the E&P segment; and statements regarding Suncor's multi year plan to deliver marked improvements in safety, reliability and operational performance. In addition, all other statements and information about Suncor's strategy for growth, expected and future expenditures or investment decisions, commodity prices, costs, schedules, production volumes, operating and financial results and the expected impact of future commitments are forward-looking statements. Some of the forward-looking statements may be identified by words like 'guidance', 'outlook', 'will', 'expected', 'estimated', 'focus', 'planned', 'believe', 'anticipate' and similar expressions.

Forward-looking statements are based on Suncor's current expectations, estimates, projections and assumptions that were made by the company in light of its information available at the time the statement was made and consider Suncor's experience and its perception of historical trends, including expectations and assumptions concerning: the accuracy of reserves and resources estimates; the current and potential adverse impacts of the COVID-19 pandemic, including the status of the pandemic and future waves; commodity prices and interest and foreign exchange rates; the performance of assets and equipment; capital efficiencies and cost-savings; applicable laws and government policies; future production rates; the sufficiency of budgeted capital expenditures in carrying out planned activities; the availability and cost of labour, services and infrastructure; the satisfaction by third parties of their obligations to Suncor; the development and execution of projects; and the receipt, in a timely manner, of regulatory and third-party approvals.

Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Suncor. Suncor's actual results may differ materially from those expressed or implied by its forward- looking statements, so readers are cautioned not to place undue reliance on them.

Assumptions for the Oil Sands operations, Syncrude and Fort Hills 2023 production outlook include those relating to reliability and operational efficiency initiatives that the company has initiated. Assumptions for the Exploration & Production 2023 production outlook include those relating to reservoir performance, drilling results and facility reliability. Factors that could potentially impact Suncor's 2023 corporate guidance include, but are not limited to:

- Bitumen supply. Bitumen supply may be dependent on unplanned maintenance of mine equipment and extraction plants, bitumen ore grade quality, tailings storage and in situ reservoir performance.

- Third-party infrastructure. Production estimates could be negatively impacted by issues with third- party infrastructure, including pipeline or power disruptions, that may result in the apportionment of capacity, pipeline or third-party facility shutdowns, which would affect the company's ability to produce or market its crude oil.

- Performance of recently commissioned facilities or well pads. Production rates while new equipment is being brought into service are difficult to predict and can be impacted by unplanned maintenance.

- Unplanned maintenance. Production estimates could be negatively impacted if unplanned work is required at any of our mining, extraction, upgrading, in situ processing, refining, natural gas processing, pipeline, or offshore assets.

- Planned maintenance events. Production estimates, including production mix, could be negatively impacted if planned maintenance events are affected by unexpected events or are not executed effectively. The successful execution of maintenance and start-up of operations for offshore assets, in particular, may be impacted by harsh weather conditions, particularly in the winter season.

- Commodity prices. Declines in commodity prices may alter our production outlook and/or reduce our capital expenditure plans.

- Foreign operations. Suncor's foreign operations and related assets are subject to a number of political, economic and socio-economic risks.

Non-GAAP Financial Measures

Oil Sands operations cash operating costs, Fort Hills cash operating costs and Syncrude cash operating costs are not prescribed by Canadian generally accepted accounting principles ('GAAP'). These non-GAAP financial measures are included because management uses the information to analyze business performance, including on a per barrel basis, as applicable, and it may be useful to investors on the same basis. These non-GAAP financial measures do not have any standardized meaning and, therefore, are unlikely to be comparable to similar measures presented by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. These non-GAAP financial measures are defined in the Non-GAAP Financial Measures Advisory section of the MD&A and, for the period ended September 30, 2022, are reconciled to the comparable GAAP measure in the MD&A, and each such reconciliation are incorporated by reference herein. Oil Sands operations cash operating costs of $30.00 - $33.00 (US $22.80 - $25.10) per barrel is based on the assumptions that: (i) Suncor will produce 385,000 - 425,000 bbls/d at Oil Sands operations (of which 290,000 - 310,000 bbls/d will be synthetic crude oil and 95,000 - 115,000 will be bitumen); and (ii) natural gas used at Suncor's Oil Sands operations (AECO - C Spot ($CAD)) will be priced at an average of $5.00/GJ over 2023. Fort Hills cash operating costs of $33.00 - $36.00 (US $25.10 - $27.40) per barrel is based on the assumptions that: (i) Fort Hills production (net to Suncor) will be 90,000 - 100,000 bbls/d; and (ii) natural gas used at Fort Hills (AECO - C Spot ($CAD)) will be priced at an average of $5.00/GJ over 2023. Syncrude cash operating costs of $39.00 - $43.00 (US $29.60 - $32.70) per barrel is based on the assumptions that: (i) Syncrude will produce 175,000 - 190,000 bbls/d of synthetic crude oil (net to Suncor); and (ii) natural gas used at Syncrude (AECO - C Spot ($CAD)) will be priced at an average of $5.00/GJ over 2023. The Syncrude cash operating costs per barrel and Fort Hills cash operating costs per barrel measures may not be fully comparable to similar information calculated by other entities (including Suncor's Oil Sands operations cash operating costs per barrel) due to differing operations.

The MD&A, together with Suncor's Annual Information Form and Annual Report to Shareholders each dated February 23, 2022, its Form 40-F dated February 24, 2022, and other documents it files from time to time with securities regulatory authorities describe the risks, uncertainties, material assumptions and other factors that could influence actual results and such factors are incorporated herein by reference. Copies of these documents are available without charge from Suncor at 150 6th Avenue S.W., Calgary, Alberta T2P 3E3; by e-mail request to [email protected]; by calling (800) 558-9071; or by referring to suncor.com/FinancialReports or to the company's profile on SEDAR at sedar.com or EDGAR at sec.gov. Except as required by applicable securities laws, Suncor disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Suncor is Canada's leading integrated energy company. Suncor's operations include oil sands development, production and upgrading, offshore oil and gas production, petroleum refining in Canada and the United States and the company's Petro-Canada retail and wholesale distribution networks, including Canada's Electric Highway, a coast-to-coast network of fast-charging EV stations. Suncor is developing petroleum resources while advancing the transition to a low-emissions future through investment in power, renewable fuels and hydrogen. Suncor also conducts energy trading activities focused principally on the marketing and trading of crude oil, natural gas, byproducts, refined products and power. Suncor has been recognized for its performance and transparent reporting on the Dow Jones Sustainability index, FTSE4Good and CDP. Suncor's common shares (symbol: SU) are listed on the Toronto and New York stock exchanges.

- 30 -

For more information about Suncor, visit our web site at suncor.com or follow us on Twitter @Suncor

Media inquiries:(833) 296-4570[email protected]

Investor inquiries:(800) 558-9071[email protected]

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/146011

This content is published on behalf of the above source. Please contact them directly for any concern related to the above.

This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Kansas City Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Kansas City Post.

More InformationInternational

SectionNew banquet rules in China after deaths, part of Xi’s crackdown

BEIJING, China: Chinese civil servants are now facing stricter rules on dining together, with some local authorities limiting group...

Tehran seeks ceasefire via Gulf allies, offers nuclear flexibility

DUBAI, U.A.E.: As violence escalates between Iran and Israel, Tehran is turning to its Gulf neighbors to help broker a ceasefire —...

Blaise Metreweli becomes first woman to head MI6

LONDON, U.K.: On June 15, Britain named Blaise Metreweli as the first woman to lead the Secret Intelligence Service, commonly known...

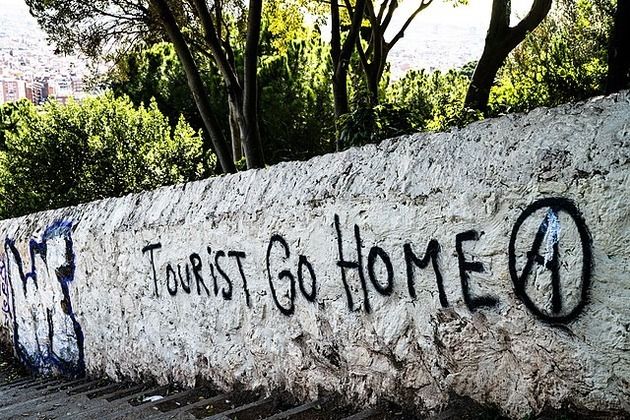

'Tourists go home': Anti-over-tourism protests erupt in Barcelona

BARCELONA/MADRID, Spain: With another record-breaking tourist season underway, thousands of residents across southern Europe marched...

Flight recorder may reveal cause of deadly crash of Air India Boeing

NEW DELHI, India: The flight data recorder from the crashed Air India plane was found on June 13. This vital discovery may help investigators...

Severe storm strikes Dongfang in Southern China

BEIJING, China: A typhoon altered its course and struck Hainan Island, southern China, late on the night of June 13. Typhoon Wutip...

Business

SectionTrump family enters telecom with branded phone, mobile service

NEW YORK CITY, New York: The Trump family has unveiled a new venture in the telecom sector — and it's drawing as much scrutiny as it...

Starmer: US-UK trade deal to be finalized 'very soon.'

KANANASKIS, Alberta: With key tariff deadlines approaching, British Prime Minister Keir Starmer said this week that finalizing the...

Aircraft orders expected as Paris airshow opens, despite recent crises

PARIS, France: The Paris Airshow kicked off on June 16, attracting attention with expected aircraft orders, but overshadowed by the...

U.S. stock markets divided as Fed leaves interest rates unchanged

NEW YORK, New York - U.S. stocks were largely range-bound Wednesday after the Federal Reserve decided to maintain the target range...

State Dept memo outlines plan to widen Trump travel ban

WASHINGTON, D.C.: The Trump administration is weighing a major expansion of its travel restrictions, with a new internal memo revealing...

Boeing trims long-term jet outlook ahead of Paris Airshow

ARLINGTON COUNTY, Virginia: As global air travel continues its recovery from the pandemic, Boeing has released a tempered 20-year outlook...