HAGENS BERMAN, NATIONAL TRIAL ATTORNEYS, Encourages MINISO Group Holdings (MNSO) Investors with Losses to Contact Firm's Attorneys, Application Deadline Approaching in Securities Class Action

ACCESS Newswire

29 Sep 2022, 21:19 GMT+10

SAN FRANCISCO, CA / ACCESSWIRE / September 29, 2022 / Hagens Berman urges MINISO Group Holdings Limited (NYSE:MNSO) investors who suffered significant losses to submit your losses now. A securities class action related to MINISO's Oct. 15, 2020, initial public offering of approximately 30.4 million American Depositary Shares at $20/share has been filed.

Relevant Period: Oct. 15, 2020 - July 26, 2021

Lead Plaintiff Deadline: Oct. 17, 2022

Visit: www.hbsslaw.com/investor-fraud/MNSO

Contact An Attorney Now: [email protected]

844-916-0895

MINISO Group Holdings Limited (NYSE:MNSO) Securities Class Action:

The litigation focuses on MINISO's repeated claims, enabling it to complete its IPO, that its business model was a high margin, asset-light network of thousands of independent franchise stores who shoulder capital expenditures and operating expenses, and on its claims it would use IPO net proceeds to expand its business operations.

The complaint alleges that the IPO offering documents misleadingly stated or failed to disclose: (1) MINISO and undisclosed related parties owned and controlled many more MINISO stores than previously stated; (2) as a result, MINISO concealed its true costs; (3) MINISO mischaracterized its true business model; (4) MINISO and its Chairman engaged in planned unusual and unclear transactions; (5) as the result of at least one of these transactions, MINISO risks breaching contracts with Chinese authorities; and, (6) MINISO would imminently and drastically drop its franchise fees.

On July 26, 2022, analyst Blue Orca Capital published a scathing report concluding in part that MINISO owns and operates about 40% of MINISO stores. Hundreds of stores are registered to company executives or persons connected to its Chairman and, 'MINISO's chairman, Ye Guofu, bilked hundreds of millions of freshly raised capital from public investors through a series of crooked transactions revolving around the purchase and construction of a massive headquarters in China.'

As of the date of the filing of the action, MINISO's ADSs trade almost 70% below the IPO price.

'We're focused on investors' losses and proving MINISO misrepresented its asset-light business model and how it would use of its IPO proceeds,' said Reed Kathrein, the Hagens Berman partner leading the investigation.

If you invested in MINISO and have significant losses, or have knowledge that may assist the firm's investigation, click here to discuss your legal rights with Hagens Berman.

Whistleblowers: Persons with non-public information regarding MINISO should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 844-916-0895 or email [email protected].

# # #

About Hagens Berman

Hagens Berman is a global plaintiffs' rights complex litigation law firm focusing on corporate accountability through class-action law. The firm is home to a robust securities litigation practice and represents investors as well as whistleblowers, workers, consumers and others in cases achieving real results for those harmed by corporate negligence and fraud. More about the firm and its successes can be found at hbsslaw.com. Follow the firm for updates and news at @ClassActionLaw.

CONTACT:

Reed Kathrein, 844-916-0895

SOURCE: Hagens Berman Sobol Shapiro LLP

View source version on accesswire.com:

https://www.accesswire.com/718049/HAGENS-BERMAN-NATIONAL-TRIAL-ATTORNEYS-Encourages-MINISO-Group-Holdings-MNSO-Investors-with-Losses-to-Contact-Firms-Attorneys-Application-Deadline-Approaching-in-Securities-Class-Action

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Kansas City Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Kansas City Post.

More InformationInternational

SectionMoscow removes Taliban from banned list, grants official status

MOSCOW, Russia: This week, Russia became the first country to officially recognize the Taliban as the government of Afghanistan since...

Netanyahu vows 'No Hamas' in postwar Gaza amid peace talks

CAIRO, Egypt: This week, both Hamas and Israel shared their views ahead of expected peace talks about a new U.S.-backed ceasefire plan....

US sends message by publicizing visa ban on UK punk-rap band

WASHINGTON, D.C.: The Trump administration has made public a visa decision that would usually be kept private. It did this to send...

Tragedy in Spain: Diogo Jota and his brother die in car accident

MADRID, Spain: Liverpool footballer Diogo Jota and his younger brother, André Silva, have died in a car accident in Spain. Spanish...

Early heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

U.S. military, China, Russia in Space race

President Donald Trump's plans to build a space-based Golden Dome missile defense shield have drawn immediate criticism from China,...

Business

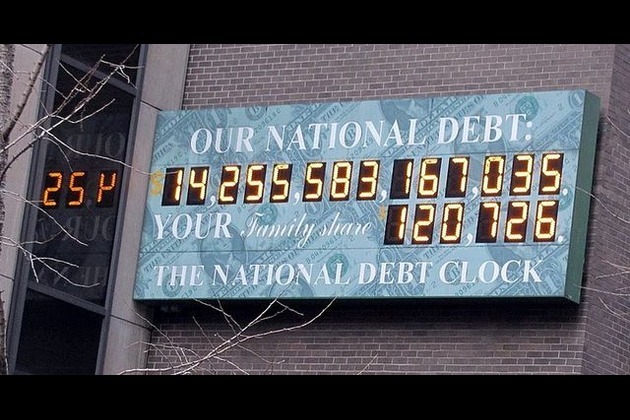

SectionUS debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Shein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...